- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

NextEra Energy Stock: Analyst Estimates & Ratings

With a market cap of $138.1 billion, NextEra Energy, Inc. (NEE) is a leading clean energy company based in Florida, known for being the largest generator of wind and solar energy in the world. It operates through two main businesses: Florida Power & Light, a regulated utility serving millions in Florida, and NextEra Energy Resources, which focuses on renewable energy and battery storage across North America.

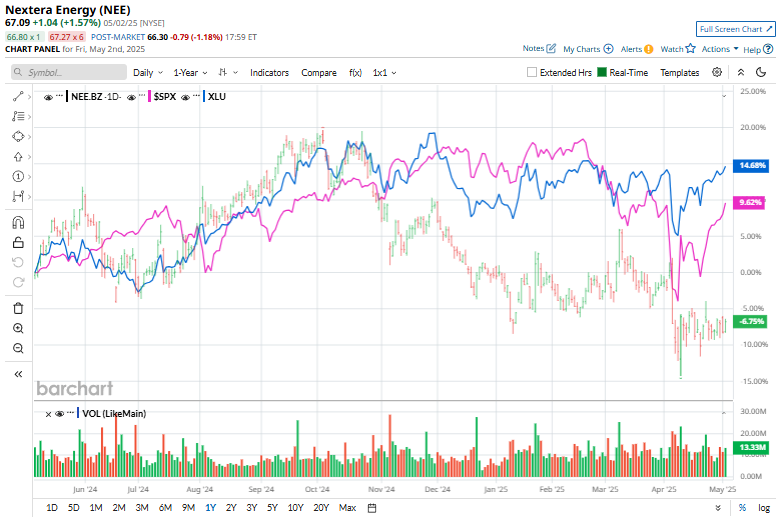

Shares of NE have lagged behind the broader market over the past 52 weeks, declining 2.6%, while the broader S&P 500 Index ($SPX) has rallied 12.3%. On a YTD basis, shares of NEE are down 6.4%, compared to SPX's 3.3% fall.

Looking closer, the clean energy titan has also underperformed the Utilities Select Sector SPDR Fund's (XLU) 17.5% return over the past 52 weeks and a 5.4% YTD gain.

NextEra Energy reported a mixed performance for Q1 2025 on Apr. 23, and its shares plunged 1.4% in the next trading session. It posted adjusted earnings per share of $0.99, surpassing analyst expectations of $0.97 and marking an 8.8% year-over-year increase. However, revenue rose 9% year-over-year to $6.24 billion but fell short of the $7.34 billion consensus estimate.

NextEra reaffirmed its 2025 adjusted EPS guidance of $3.45 to $3.70 and anticipates 6–8% annual EPS growth through at least 2027. While the company benefits from strong demand and a robust renewable energy pipeline, it faces potential risks related to its reliance on Chinese supply chains for key components like batteries, amid escalating U.S.-China trade tensions.

For the current fiscal year, ending in December 2025, analysts expect NEE's EPS to grow 7.3% year-over-year to $3.68. The company's earnings surprise history is robust. It beat the consensus estimates in the last four quarters.

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, seven “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, when the stock had 12 “Strong Buy” ratings.

On April 22, Barclays PLC (BCS) lowered its price target for NextEra from $77 to $73 while maintaining an “Equal Weight” rating. The adjustment reflects updated utilities sector models ahead of Q1 earnings, factoring in macroeconomic conditions and the evolving U.S. utilities tariff outlook. Barclays noted that the sector remains attractive due to its defensive nature, suggesting it may continue to re-rate positively.

NEE’s mean price target of $81.74 indicates a premium of 8.4% from the current market prices. The Street-high price target of $97 implies a potential upside of 44.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.