- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

Earnings Preview: What to Expect From Martin Marietta Materials' Report

Raleigh, North Carolina-based Martin Marietta Materials, Inc. (MLM) is a natural resource-based building materials company. The company supplies aggregates and building materials to the construction industry. With a market cap of $38.4 billion, Martin Marietta’s operations span the United States and internationally.

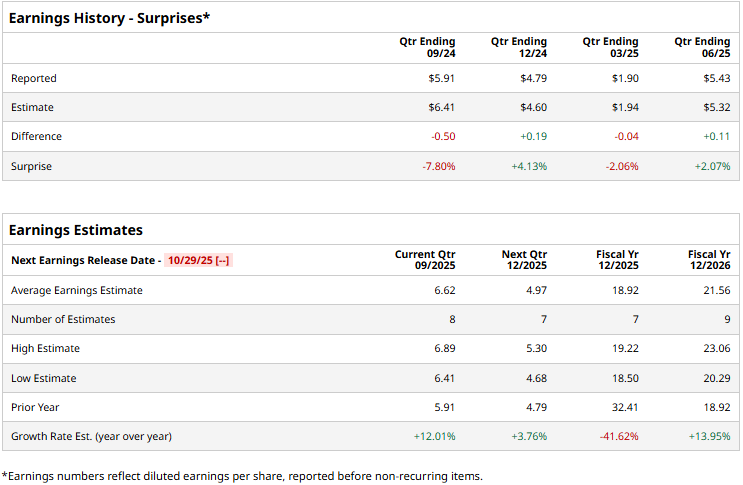

The building materials giant is set to unveil its third-quarter results before the market opens on Wednesday, Oct. 29. Ahead of the event, analysts expect MLM to deliver a profit of $6.62 per share, up 12% from $5.91 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it missed the projections on two other occasions.

For the full fiscal 2025, MLM’s EPS is expected to come in at $18.92, down 41.6% from $32.41 reported in 2024. While in fiscal 2026, its earnings are expected to grow 14% year-over-year to $21.56 per share.

MLM stock prices have soared 19.3% over the past 52 weeks, notably outpacing the Materials Select Sector SPDR Fund’s (XLB) 6.7% decline and the S&P 500 Index’s ($SPX) 16.3% returns during the same time frame.

Martin Marietta Materials’ stock prices observed a marginal gain in the trading session following the release of its mixed Q2 results on Aug. 7. The quarter was marked with sustained pricing momentum and effective cost management. The company reported record quarterly aggregate revenues; its topline for the quarter inched up 2.7% year-over-year to $1.8 billion, but fell 33 bps below the Street’s expectations.

Meanwhile, driven by improvement in margins and decrease in the number of outstanding shares, the company’s EPS soared 14.1% year-over-year to $5.43, beating the consensus estimates by 2.1%.

Analysts remain optimistic about the stock’s long-term prospects. MLM has a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the stock, 12 suggest “Strong Buys,” one advises “Moderate Buy,” and seven recommend “Holds.” As of writing, the stock is trading slightly below its mean price target of $645.69.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.