- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

Earnings Preview: What To Expect From American Water Works’ Report

Camden, New Jersey-based American Water Works Company, Inc. (AWK) provides water and wastewater services in the United States. Valued at $27.5 billion by market cap, the company operates approximately 80+ surface water treatment plants, 520+ groundwater treatment plants, and 190+ wastewater treatment plants.

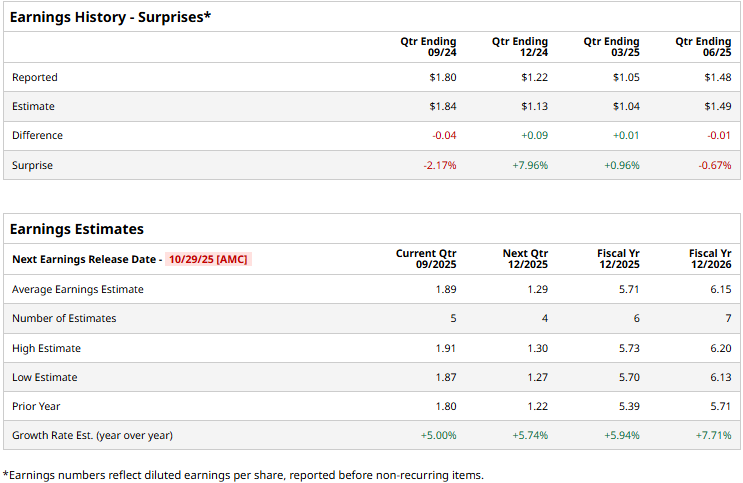

The utilities giant is set to announce its third-quarter results after the markets close on Wednesday, Oct. 29. Ahead of the event, analysts expect AWK to deliver a profit of $1.89 per share, up 5% from $1.80 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it surpassed the projections on two other occasions.

For the full fiscal 2025, AWK is expected to deliver an EPS of $5.71, up 5.9% from $5.39 reported in 2024. While in fiscal 2026, its earnings are expected to grow 7.7% year-over-year to $6.15 per share.

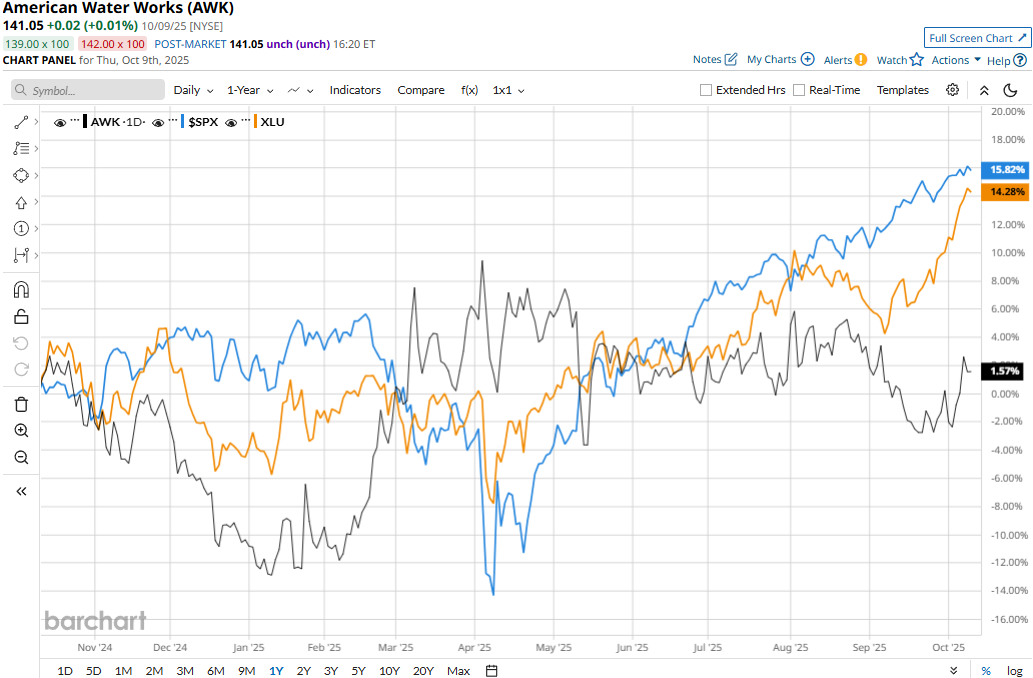

AWK stock prices have inched up 3.6% over the past 52 weeks, notably lagging behind the Utilities Select Sector SPDR Fund’s (XLU) 14.9% gains and the S&P 500 Index’s ($SPX) 16.3% surge during the same time frame.

American Water’s stock prices observed a marginal uptick in the trading session following the release of its mixed Q2 results on Jul. 30. The company has continued to observe solid momentum in the first half of 2025, its operating revenues for the quarter surged 11.1% year-over-year to $1.3 billion, exceeding the Street’s expectations by a significant 10.5%, boosting investor confidence. Meanwhile, the company’s EPS for the quarter increased 4.2% year-over-year to $1.48, missing the consensus estimates by 1 cent.

Analysts remain cautious about the stock’s prospects. AWK maintains an overall consensus “Hold” rating. Of the 14 analysts covering the stock, opinions include three “Strong Buys,” eight “Holds,” two “Moderate Sell,” and one “Strong Sell.” As of writing, the stock is trading slightly below its mean price target of $143.10.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.