- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

What to Expect From Automatic Data Processing's Next Quarterly Earnings Report

Roseland, New Jersey-based Automatic Data Processing, Inc. (ADP) engages in the provision of cloud-based human capital management (HCM) solutions worldwide. With a market cap of $117.8 billion, Automatic Data Processing operates through Employer Services and Professional Employer Organization (PEO) segments.

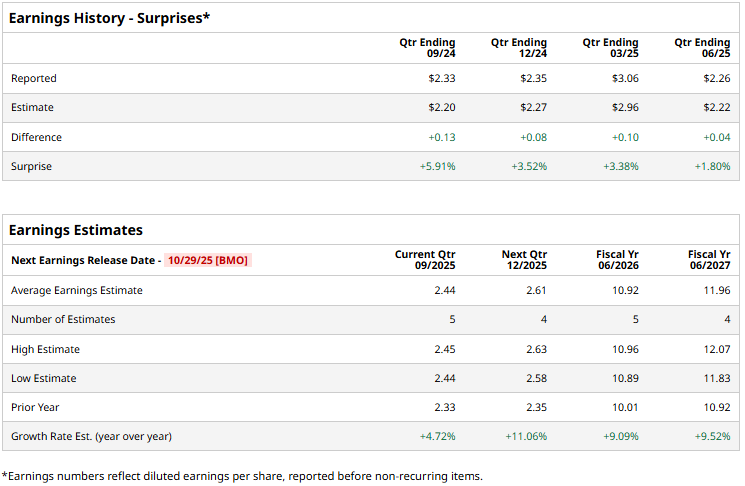

The HCM giant is set to announce its first-quarter results before the markets open on Wednesday, Oct. 29. Ahead of the event, analysts expect ADP to deliver an adjusted profit of $2.44 per share, up 4.7% from $2.33 per share reported in the year-ago quarter. On a more positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2026, ADP’s adjusted EPS is expected to come in at $10.92, up 9.1% from $10.01 reported in 2025. In fiscal 2027, its earnings are expected to further surge 9.5% year-over-year to $11.96 per share.

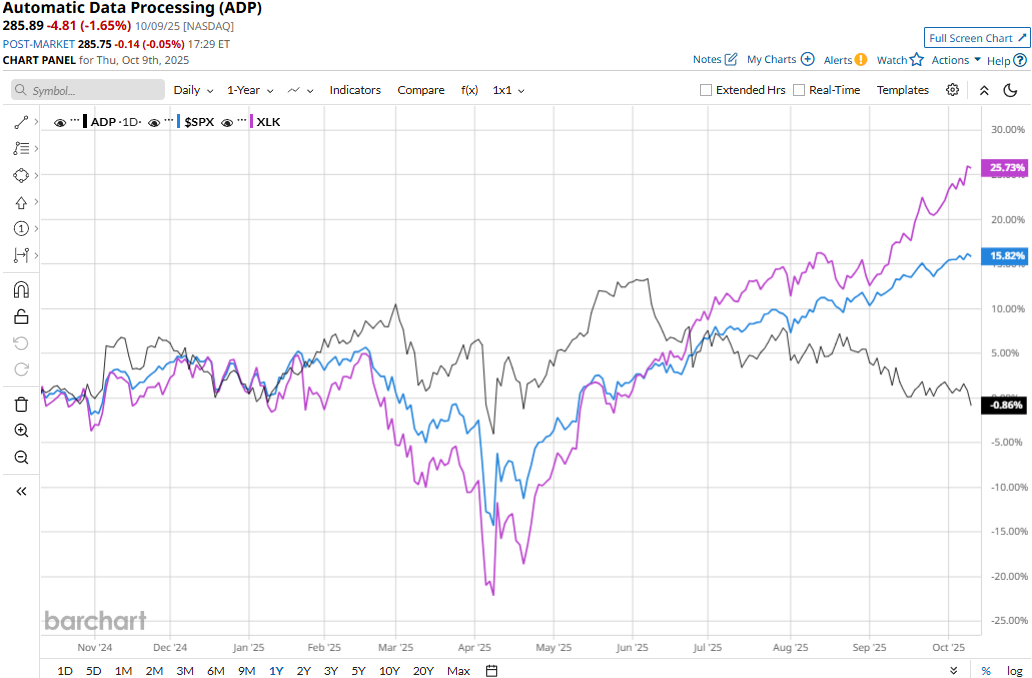

ADP stock prices have dipped 65 bps over the past 52 weeks, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 25.9% surge and the S&P 500 Index’s ($SPX) 16.3% returns during the same time frame.

Automatic Data’s stock prices observed a marginal uptick in the trading session following the release of its solid Q4 results on Jul. 30. The company ended the fiscal 2025 on a strong note. Driven by the resilience of its business model, the company was able to navigate through uncertainties and deliver impressive growth. Overall, ADP’s net revenues for the quarter came in at $5.1 billion, up 7.5% year-over-year and 1.5% above the Street’s expectations. Further, its adjusted EPS grew 8.1% year-over-year to $2.26, beating the consensus estimates by 1.8%.

However, analysts remain cautious about the stock’s prospects. ADP maintains an overall consensus “Hold” rating. Of the 17 analysts covering the stock, opinions include three “Strong Buys,” 13 “Holds,” and one “Strong Sell.” Its mean price target of $318.54 suggests an 11.4% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.