- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

What to Expect From AbbVie's Q3 2025 Earnings Report

/Abbvie%20Inc%20logo%20and%20meds-%20by%20Ascannio%20via%20Shutterstock.jpg)

North Chicago, Illinois-based AbbVie Inc. (ABBV) focuses on creating medicines and solutions that address complex health issues and enhance people's lives through its core therapeutic areas: immunology, oncology, neuroscience, eye care, aesthetics, and more. With a market cap of $408.5 billion, AbbVie operates as one of the largest biopharmaceutical companies in the world.

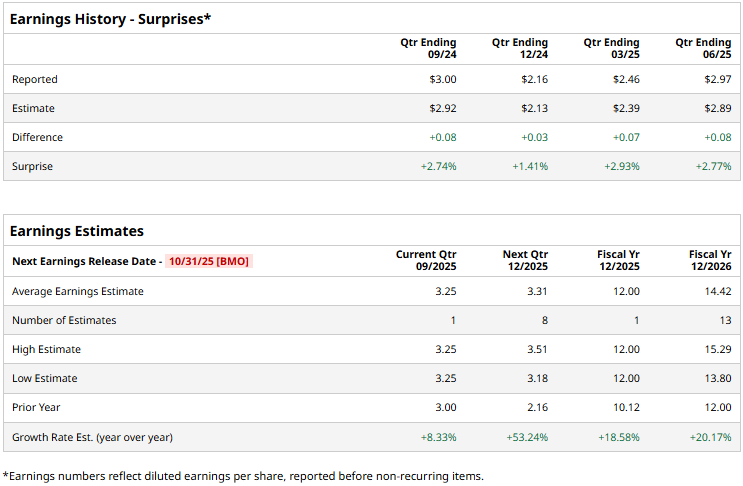

The pharma giant is gearing up to announce its third-quarter results before the market opens on Friday, Oct. 31. Ahead of the event, analysts expect ABBV to report an adjusted profit of $3.25 per share, up 8.3% from $3 per share reported in the year-ago quarter. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, ABBV is expected to deliver an adjusted EPS of $12, up 18.6% from $10.12 reported in 2024. In fiscal 2026, its earnings are expected to further surge 20.2% year-over-year to $14.42 per share.

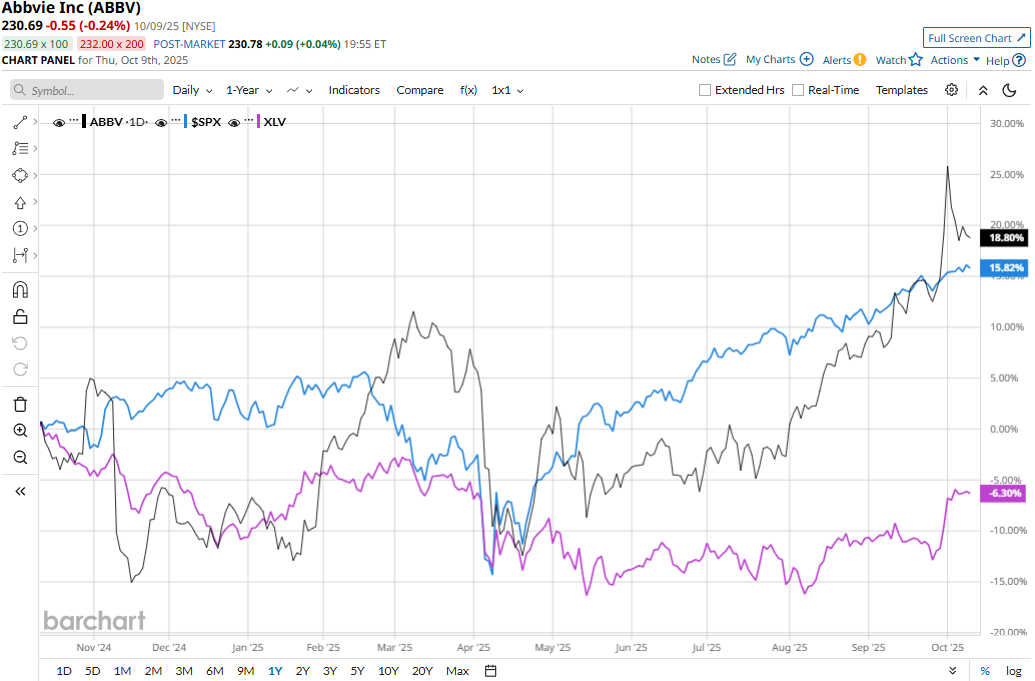

ABBV stock prices have soared 18.5% over the past 52 weeks, notably outperforming the Healthcare Select Sector SPDR Fund’s (XLV) 6% decline and the S&P 500 Index’s ($SPX) 16.3% returns during the same time frame.

AbbVie’s stock prices remained mostly flat in the trading session following the release of its impressive Q2 results on Jul. 31. Driven by the strength of its diversified growth platform, the company has continued to deliver solid growth figures. Its net revenues for the quarter increased 6.6% year-over-year to $15.4 billion, beating the Street’s topline expectations by 2.4%. Further, its adjusted EPS surged 12.1% year-over-year to $2.97, surpassing the analysts' estimates by 2.8%.

Moreover, the company made meaningful progress with several regulatory approvals during the quarter and also raised its full-year outlook. Following the initial muted response from the market, ABBV stock prices soared more than 5% in three subsequent trading sessions.

Analysts remain optimistic about the stock’s long-term prospects. ABBV has a consensus “Moderate Buy” rating overall. Of the 28 analysts covering the stock, 16 suggest “Strong Buys,” two advise “Moderate Buys,” and 10 recommend “Holds.” As of writing, the stock is trading slightly below its mean price target of $233.48.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.